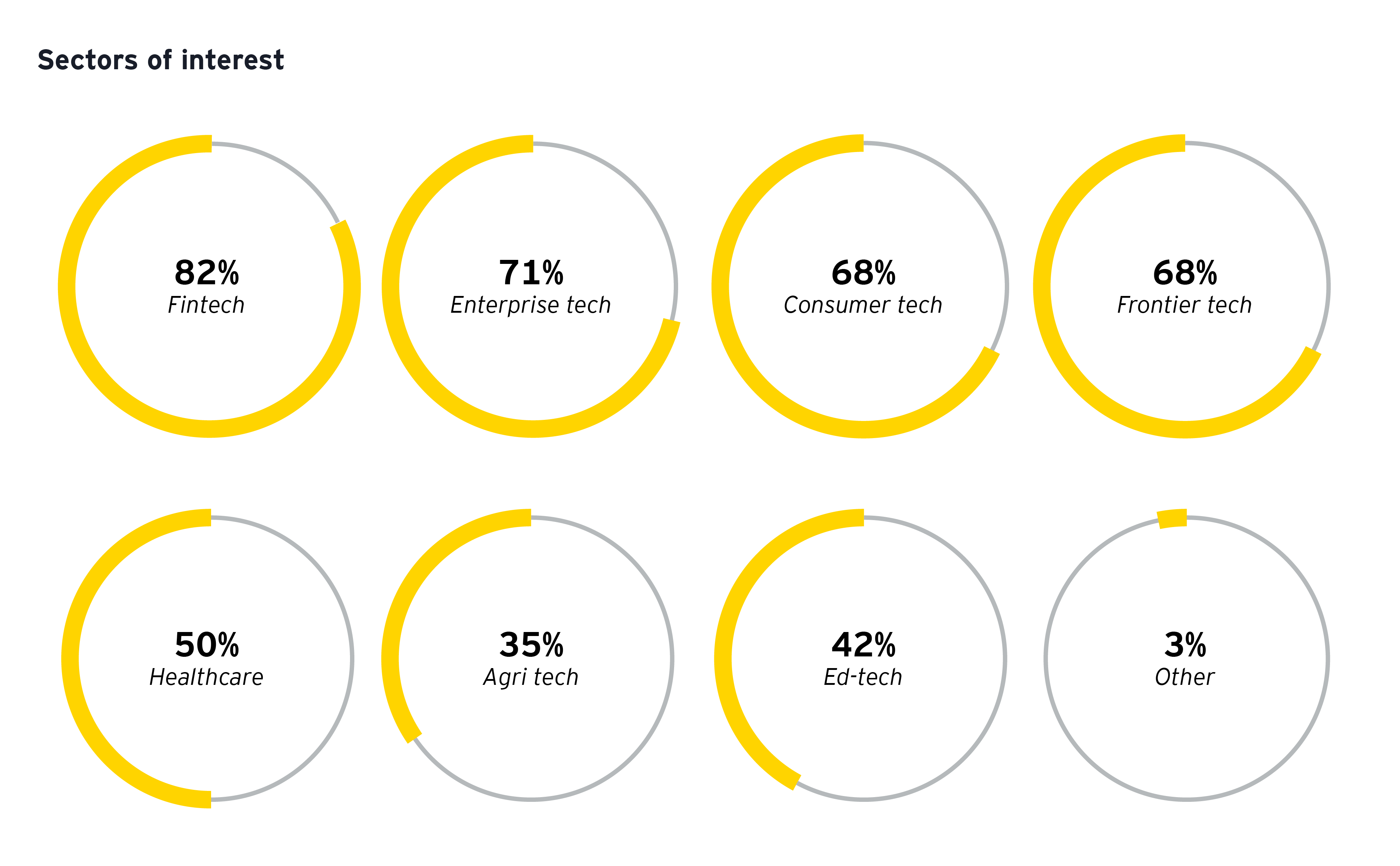

Enterprise tech is riding the wave created by the large number of Indian software product companies that have successfully gone global — the recently Nasdaq listed Freshworks being the poster boy of Indian SaaS. A surprise was seeing muted conviction for the consumer tech space and this preference being tied to frontier tech opportunities

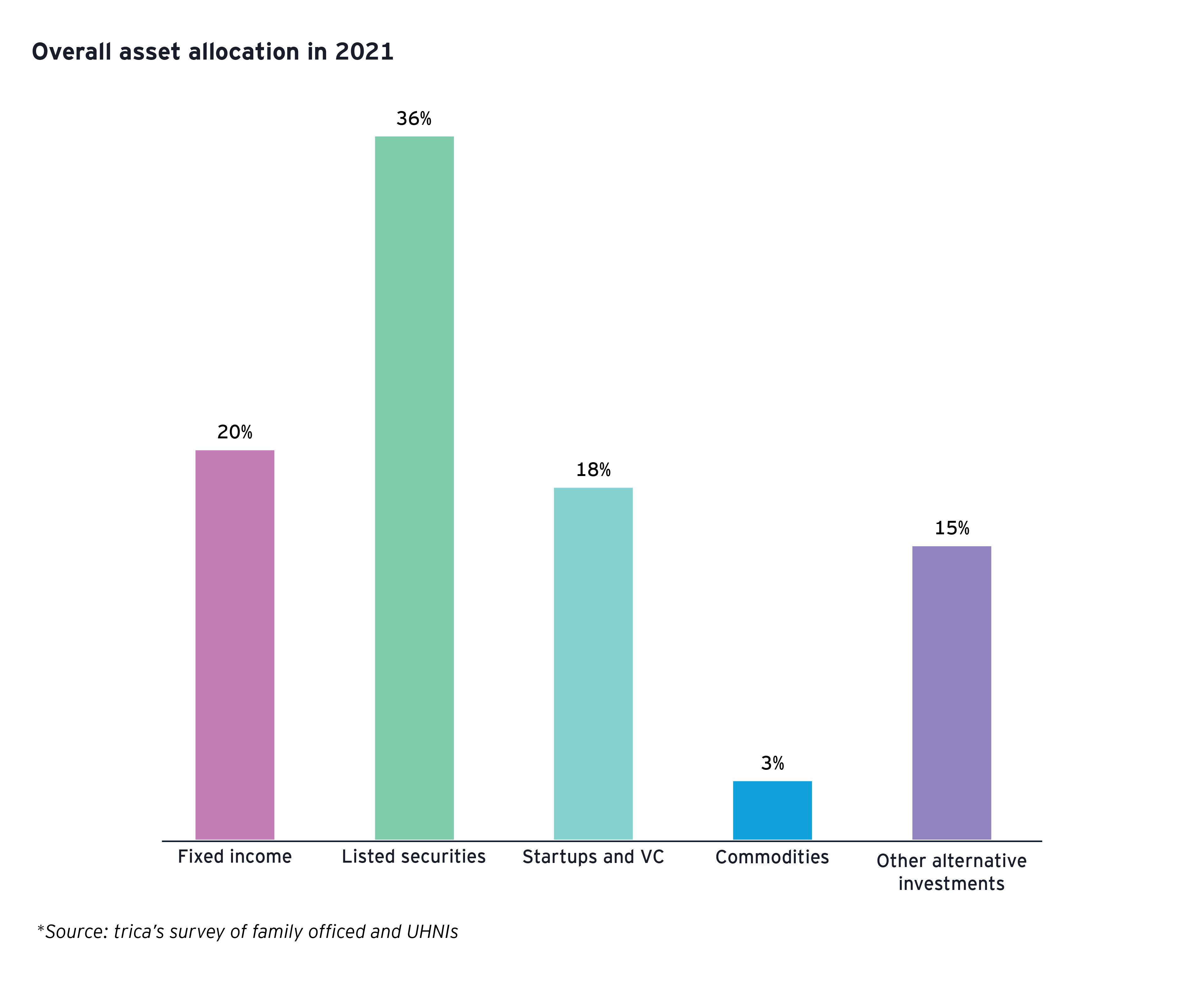

Globally too we have seen record breaking funding activities in 2021- more than $288 billion was invested worldwide. This acceleration of capital deployment has generated more unicorns, more mega-rounds and more available dollars than ever before in the history of startups. Since there are no fixed investment regulations that apply to family offices, they tend to follow their own individual investment policies. Family offices can often diversify their assets very broadly, much more than institutional investors, depending on the amount of assets under management and freedom from investment regulations.

In EY’s Global family office Study 2021, we saw that the most significant concern among family offices is heightened government or public requirements for global transparency and information exchange. 53% of our surveyed family offices express concern about a number of regulatory issues, including growing tax complexity. family offices, like traditional asset managers, often rely on outside professionals to assist with specific services that are not carried out in-house (e.g., M&A advisory, capital markets advisory, legal advisory, tax advisory, accounting). So, the growing regulatory concerns means they need to outsource these services to professionals. Over time, however, as it gains experience and builds out its infrastructure, many of these professional services can be brought in-house. There is also awareness of making investments based on the potential societal or environmental impact globally. There are also measures taken to evaluate non-financial metrics when considering potential investments. This is one area Indian family offices are lagging.

From our global survey, most family offices are considering the use of external expertise to bolster their in-house capabilities across a range of areas. On average, 67% of family offices are either currently outsourcing or considering outsourcing in areas like:

- Estate and wealth transfer planning

- Information security management

- Business Tax Advisory

- Compliance and regulatory assistance

- Investment management and asset allocation

This highlights that, whatever aspects they are best-in-class in, family offices are generally still opting to outsource some aspects rather than build capabilities. Many offices are still emerging from the era of spreadsheets stored on desktops. Only a small percentage have deployed more sophisticated systems focused on automating workflow processes, providing remote approvals or integrating disparate functions.

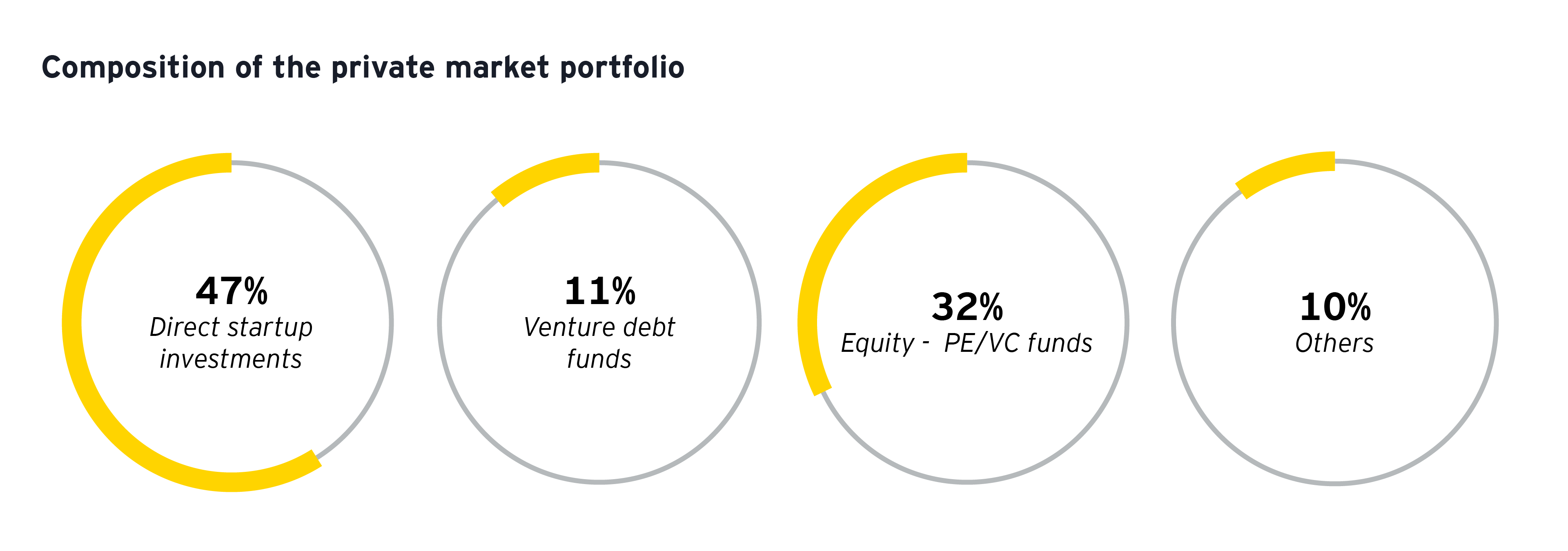

For India and globally, the next five years look favourable, and we will get to witness a substantial growth in the startup space. With more family offices and UHNIs moving away from traditional investment routes, private market shows potential with high returns.

Reshmi Mary Paul, Senior Analyst, Private Tax has also contributed to this article.